- US Dollar & Interest Rates – With the dollar under pressure and market expectations for rate cuts by the Federal Reserve remaining alive, gold continues to benefit from its non-yielding appeal.

- Safe-Haven Demand / Geopolitical Risk – Global economic uncertainty and geopolitical tensions continue to underpin demand for gold as a hedge against volatility.

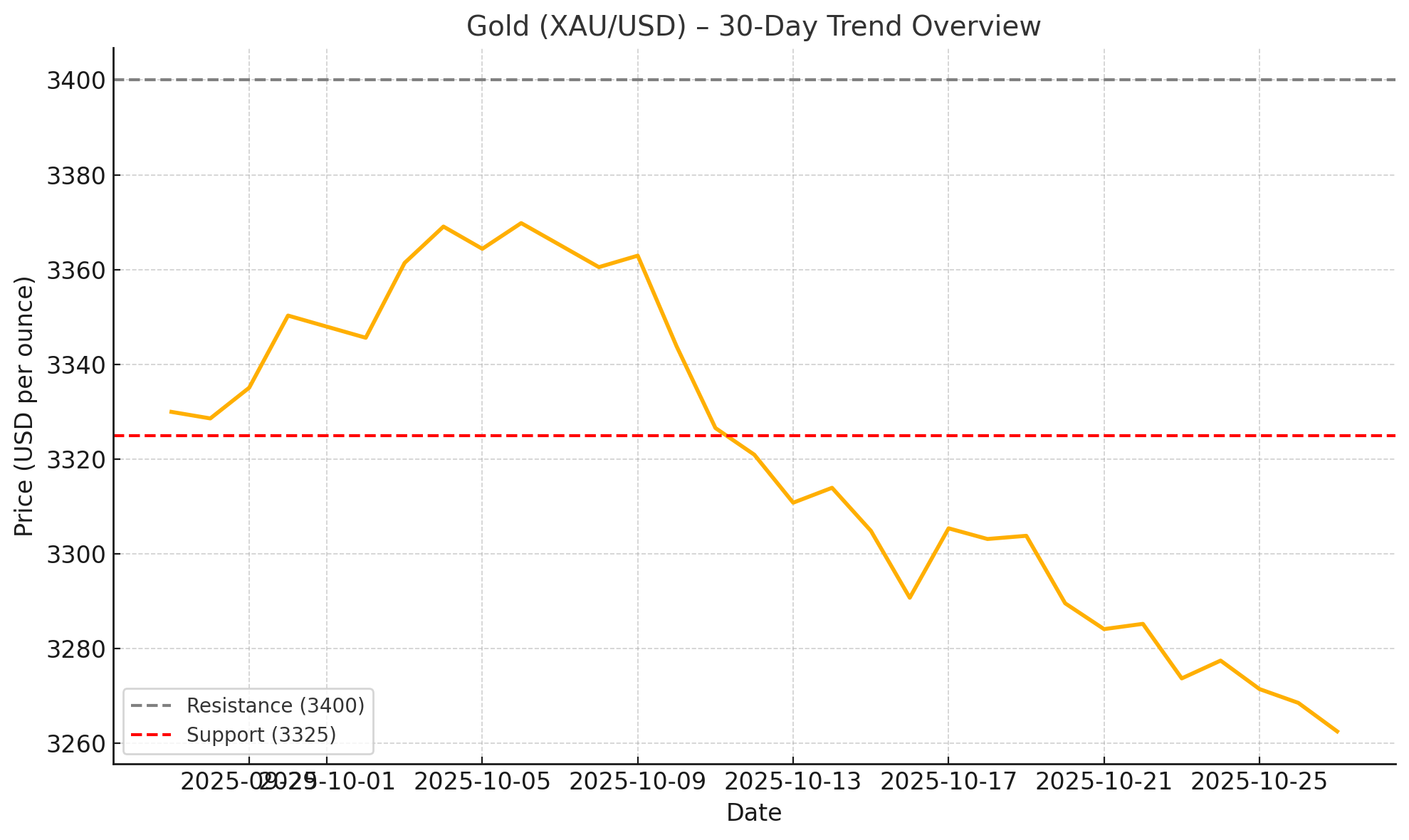

- Technical Structure – From a technical standpoint, gold appears to be navigating between key support and resistance zones. The metal remains well above major support, though upside momentum is currently modest.

Technical Outlook

- Support levels: Should gold retrace, key support lies around the USD 3,300–3,325 zone. A break below could open the way toward USD 3,250.

- Resistance levels: On the upside, the next key barrier is around USD 3,400, and further resistance may appear near USD 3,440 if bullish momentum strengthens.

- Range-bound risk: Gold is likely to consolidate between these levels until a major catalyst — such as inflation data, central-bank policy shifts, or geopolitical events — drives a breakout.

Client Advisory – OrderGlo Accounts

- For long positions: Gold remains a valuable hedge amid ongoing uncertainty. Maintain positions with caution, as upside momentum is steady but not aggressive.

- For new entries: Wait for a confirmed breakout above resistance or a pull-back near support for improved risk-to-reward positioning.

- Risk management: Expect range-bound behavior and adjust stop-losses and profit targets accordingly. Position sizing should account for volatility.

- Upcoming data to watch: US inflation (PCE), employment (NFP), and central-bank statements — all potential catalysts for short-term movement in XAU/USD.

Leave A Comment