What Is Forex Trading? A Simple Introduction for Indian Beginners

Forex trading (foreign exchange trading) is buying or selling one currency in exchange for another. It takes place on a decentralized global market where banks, governments, institutions and individual traders exchange currencies around the clock (except weekends). Unlike stock markets, Forex trading happens over-the-counter (OTC) between participants worldwide. Because of its 24/5 nature and vast scale, Forex is extremely liquid; for example, a global survey found that daily FX volume was about $7.5 trillion in April 2022. The largest share of this activity is in London (about 38% of trading) and New York (19%), meaning the market is busiest when those financial centers are open.

What is the foreign exchange market and how does it work?

At its core, the forex market is where currencies are quoted in pairs, like USD/INR (US dollar vs Indian rupee) or EUR/GBP (Euro vs British pound). Each quote has a base currency and a quote currency (e.g. in USD/INR, the base is USD and the quote is INR). Traders take positions by buying one currency and simultaneously selling another. For example, if you expect the rupee to weaken vs the dollar, you might buy USD/INR (which is like buying USD with INR). The market price changes constantly based on supply and demand for each currency pair. Key drivers include interest-rate differences, economic data (GDP, inflation), political events, and market sentiment. Central bank policies are major movers – for instance, if the US Fed raises rates while the RBI holds rates steady, the US dollar may strengthen.

The Forex market is open 24 hours (Monday–Friday), because trading centers “hand off” as night falls in one region and morning breaks in another. It truly never sleeps: when Asian markets close in the afternoon (India time), London opens; when London closes, New York opens; and so on. This continuous trading means there are always opportunities, but also always some volatility to manage.

Key terms every Indian beginner must know (pips, leverage, spreads, lots)

- Pip: The smallest price increment a currency pair can move. For most pairs, 1 pip is 0.0001 of the price (e.g. from 74.5000 to 74.5001 INR per USD is one pip). Pip stands for “percentage in point”.

- Lot: A standardized trade size. A standard lot is usually 100,000 units of the base currency (so for USD/INR, one lot = 100,000 USD). There are also mini (10,000), micro (1,000) and nano lots for smaller traders.

- Spread: The difference between the buy price (ask) and sell price (bid). Brokers charge the spread as a fee. Low spreads (e.g. 0.3 pips) mean cheaper trading costs. For example, Orderglo’s Standard account offers spreads as low as 0.3 pips.

- Leverage: A way to control a bigger position with less capital. For instance, 1:100 leverage means you only need $1,000 margin to control a $100,000 position. Higher leverage (like up to 1:300 or 1:400) is common but amplifies risk. Orderglo offers up to 1:300 on its Standard account and even 1:500 on higher-tier accounts.

- Margin: The deposit required to open and maintain a leveraged position. Your broker will calculate margin based on leverage and trade size.

Why Forex trading is popular in India today

Several trends have made Forex trading appealing to Indian investors. Widespread internet and smartphone access (India had about 1.12 billion mobile connections by early 2024) make online trading easy. A young, tech-savvy population is keen on new income opportunities. Furthermore, Indians often remit money globally for education or business, so they pay attention to currency moves. Culturally, there is interest in markets and speculation alongside conservative saving habits. As one analysis noted, India has “a substantial number of developing traders,” including students and professionals looking for additional income. Finally, Forex education and social trading are more available than ever, so beginners feel they can learn to trade.

That said, it’s important to remember that forex trading carries high risk. Many beginners underestimate how challenging it is to be profitable. We will cover strategies and risk management below.

Is Forex Trading Legal in India? Understanding the Regulations

A common question is “is forex trading legal in India?” The short answer is: Yes, but with strict rules. In India, residents cannot just trade any currency pair or use any online broker without following Indian laws. Forex deals for Indian residents must comply with the Foreign Exchange Management Act (FEMA) and RBI/SEBI regulations.

RBI and SEBI rules Indian traders must follow

The Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) allow currency trading only on authorized platforms. In practice, that means trading currency derivatives (futures/options) on recognized stock exchanges (NSE, BSE, or MSE) or RBI-authorized electronic trading platforms (ETPs). A recent RBI FAQ explicitly states: “Permitted forex transactions executed electronically should be undertaken only on electronic trading platforms (ETPs) authorised by RBI or on recognised stock exchanges (NSE, BSE, MSE)”. Any resident trading on an unauthorized foreign site “shall render themselves liable for penal action under FEMA”. SEBI has echoed this caution, issuing advisories about unregulated “virtual trading” platforms that claim to offer offshore Forex or CFD services. In short, Indian law does not permit residents to trade with random overseas brokers offering USD/EUR or Bitcoin/forex CFDs. Trading with such unregulated brokers is considered illegal and carries risks (see next section).

What currency pairs are allowed for Indian residents?

Currently, Indians are allowed to trade only INR-based currency pairs on authorized venues. Common permitted pairs on NSE and BSE include USD/INR, EUR/INR, GBP/INR, and JPY/INR. These are traded via currency futures and options contracts. Trading USD/EUR or any pair that doesn’t involve INR is generally not available to ordinary Indians (except for specific hedging by exporters or foreign investment, which is beyond beginner scope). In other words, forex trading in India is restricted to INR pairs. If you see a platform offering exotic pairs (like AUD/CAD) directly to a retail Indian, it’s almost certainly outside the legal framework. Always check that the trades you make are on SEBI-regulated instruments.

Risks of trading with unregulated offshore brokers

Many offshore brokers aggressively market their Forex CFDs to Indians. Trading with them is risky. Firstly, they are not regulated by Indian authorities, so you have no investor protection. If the broker goes bust or manipulates prices, you likely lose your money. Secondly, as noted above, this practice violates FEMA rules. The RBI periodically publishes an “alert list” of unauthorized trading entities. As of late 2025, the RBI’s list had grown to 95 names (with seven more added in November 2025). Examples include well-known international firms that Indian regulators have warned against. SEBI and RBI have both cautioned that “platforms offering virtual trading services” of overseas FX are effectively running illegal schemes. In summary: for both legal safety and financial security, stick to authorized brokers and instruments. If in doubt, check the RBI Alert List and SEBI advisories before trading with any offshore firm.

How the Forex Market Works (Explained for Absolute Beginners)

To trade well, it helps to understand the market’s mechanics: what kinds of currency pairs there are, what influences their prices, and the nature of market activity.

Major vs minor vs exotic currency pairs

Currency pairs fall into categories:

- Major pairs: Always include the US dollar on one side. Examples: EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, USD/CAD, NZD/USD. Majors have the highest liquidity.

- Minor (cross) pairs: Pair two major currencies, but without USD. E.g., EUR/GBP, EUR/JPY, GBP/JPY. They are fairly liquid but less so than majors.

- Exotic pairs: Pair a major currency with an emerging-market currency. E.g., USD/INR, USD/SGD, EUR/TRY. These have wider spreads and less liquidity. In India, USD/INR and EUR/INR are “exotic” in a sense but are legally traded on exchanges. Truly exotic pairs (like USD/TRY) are generally not offered to Indian retail traders.

What moves currency prices in global markets?

Currency prices are driven by economic fundamentals and market sentiment. Important factors include:

- Interest rate differences: Currencies of countries with higher interest rates often strengthen, all else equal. If the RBI raises rates relative to the Fed, INR could strengthen vs USD.

- Economic data: GDP growth, employment, inflation figures can move currencies as they change rate expectations.

- Trade flows: A country that exports much more than it imports may see its currency strengthened by higher demand.

- Geopolitical events: Elections, trade wars, or unexpected crises (like a pandemic) can cause sudden currency shifts.

- Market sentiment and risk appetite: In “risk-off” times, traders might flock to perceived safe havens (like USD or JPY). In “risk-on” times, they may buy higher-yielding currencies.

No single indicator tells the full story; most traders use a combination of news events and technical analysis to forecast currency moves. Be wary of “economic calendar” releases – these can trigger spikes in volatility.

How to Start Forex Trading in India Step-by-Step

Choosing a SEBI/RBI-compliant way to trade

First, you must use an approved channel. The safest compliant route is trading currency futures/options on the NSE or BSE via a registered stockbroker. This way you trade INR pairs under Indian regulation. If you want direct Forex access (including non-INR pairs), be aware it’s not officially permitted for residents. Some traders open accounts with international brokers anyway – but they do so with the understanding it’s outside RBI norms (and there’s no legal recourse if things go wrong).

A more recent option is “portfolio management services” (PMS) or mutual funds that offer currency funds, which operate within regulation. But for most beginners, the choice is:

- Either stick to exchange-traded INR currency contracts (very safe legally),

- Or carefully select an international broker and trade with it from abroad (understanding the risks and regulatory grey area).

Whichever you pick, do not attempt manual offshore fund transfers for margin – RBI’s Liberalised Remittance Scheme (LRS) prohibits sending money abroad specifically for forex margin. Use only the payment methods your broker provides.

Selecting a safe and trusted Forex broker

If you go the broker route, choose reputation and regulation. Top-tier international brokers are usually regulated by authorities like the FCA (UK), CySEC (EU), ASIC (Australia), or CIMA (Cayman Islands). For example, Orderglo (OG Markets) is regulated by the Cayman Islands Monetary Authority (CIMA) under licence number 1636242. This means it must follow strict KYC/AML rules and maintain segregated client funds. Before opening an account, verify your broker’s licence and check reviews on sites like TrustPilot or ForexPeaceArmy.

Look for the following in a broker:

- Regulation: See the regulator’s website for licence status.

- Trading costs: Compare spreads and commissions (e.g. Orderglo’s Standard account has 0.3 pip spreads).

- Leverage: Higher leverage means more risk; choose according to your comfort (Orderglo offers up to 1:400 on higher accounts).

- Platform and tools: Quality charts, fast execution, and educational resources.

- Customer support: Indian traders benefit from 24/5 support and even local-language help. Orderglo offers around-the-clock support and a large library of trading tools.

- Deposit/withdrawal options: Check if the broker supports easy payment methods (credit cards, e-wallets, local bank transfers). Many brokers now accept rupee deposits via payment gateways or UPI. (Orderglo, for instance, advertises “instant transactions” via 10+ funding methods.)

- Demo account: Always use a free demo first to test the platform without risk.

In summary: do your due diligence. A scammy broker might promise unrealistic profits (the FCA has warned that 80–95% of retail FX accounts lose money). A legitimate broker won’t.

Account opening, verification, and funding methods for Indian traders

Opening an account is usually straightforward:

- Register on the broker’s website. Fill in basic details (name, email).

- Complete KYC (Know Your Customer). Upload ID (passport or Aadhar/PAN card) and proof of address (utility bill or bank statement). This is required by law.

- Choose account type. Many brokers (like Orderglo) offer multiple tiers: Standard, Premium, VIP, etc., with different min deposits and features. For example, Orderglo’s Standard Forex account requires $500 minimum with 1:300 leverage, while its Premium account requires $5000 with 1:400 leverage.

- Fund your account. Approved methods often include wire bank transfer, credit/debit cards, and e-wallets (Skrill, Neteller, PayPal in some cases). Orderglo supports 10+ instant funding methods, making it convenient for Indian users. Always check deposit fees and processing times. For example, wire transfers can take a day or two, whereas card transactions or UPI (if offered) may be instant.

- Start trading. Once funds land, you can open positions.

Special note: some brokers offer “funded account programs” (or trading challenges) for beginners. Orderglo has an OG Challenge where you pay a fee (e.g. $99) and if you hit a modest profit target in demo mode, you gain access to a $5,000 funded account. This lets novices trade with bigger capital and limited personal risk. It’s an advanced step, but worth mentioning for ambitious learners.

Essential Forex Trading Tools for Beginners

Having the right tools can make a big difference. Here are some essentials:

Trading platforms (MT4, MT5, OG Platform)—which is best for Indians?

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the industry standards. They are free platforms used by most brokers. MT4 is very popular for Forex, while MT5 adds more features (like stock trading and more timeframes). Both offer interactive charts, automated trading (expert advisors), and thousands of available indicators. Indian traders can easily download MT4/5 on desktop or mobile from any regulated broker. Many beginners start with MT4 due to its simplicity and wide tutorial support.

- Orderglo’s OG Platform: This is Orderglo’s proprietary platform (also available on web, desktop and mobile). It boasts “ultra-fast trade execution” and no re-quotes. It offers multiple chart layouts and a large set of tools (Orderglo advertises 250+ trading tools). It’s designed to be user-friendly and stable. In practice, which platform is “best” depends on personal preference. MT4/5 has the widest support, while OG Platform (and others like cTrader) may offer convenience or extra features. Indians should try demos of each to see which interface they like. All are available in English and many support additional languages.

Forex calculators, indicators, and charting tools

- Calculators: Position-size calculators help you determine how many lots to trade for a given stop-loss so that you risk only, say, 1% of your account. Pip and margin calculators compute profits or required margin. These are usually free tools or built into platforms.

- Technical indicators: Beginners often use RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), moving averages (MA) and Bollinger Bands. These indicators (built into MT4/5 and OG Platform) can signal overbought/oversold conditions or trend strength. Start simple: many beginners just plot a 50-day MA or look at RSI to identify momentum shifts.

- Charting tools: Drawing trendlines, support/resistance lines, and Fibonacci retracements helps in visual analysis. Good platforms let you mark these by mouse. Keep charts clean and look for major levels rather than tiny ones.

Most brokers also offer educational charting websites or apps. The key is practice: open live or demo charts daily and try to interpret price patterns.

Mobile vs desktop trading for Indian users

Many Indian traders prefer mobile trading apps because of convenience. In 2024 India had roughly 1.12 billion cellular connections (78% of population), so smartphone trading is natural for many. Apps (MT4 Mobile, MT5 Mobile, or Orderglo’s mobile app) let you trade on the go and monitor prices at all times.

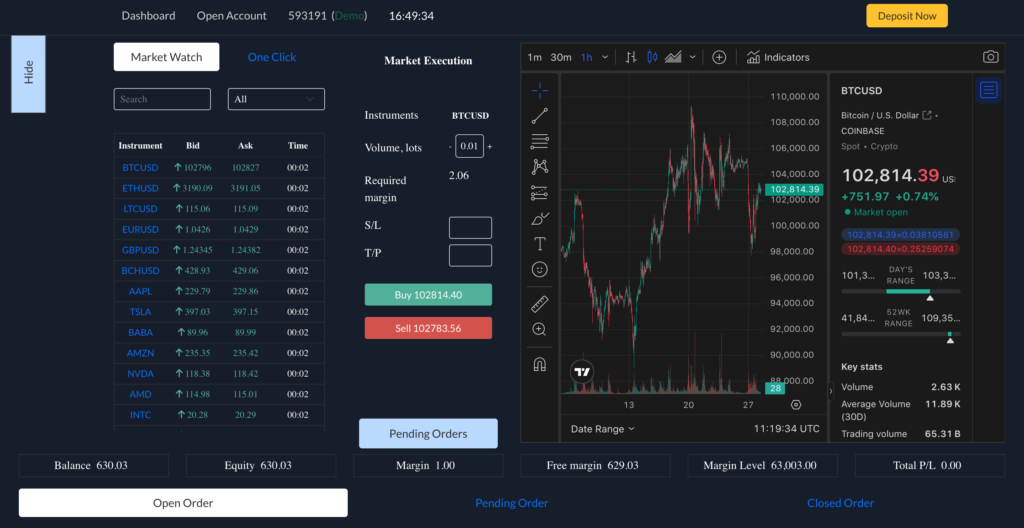

Screenshot of a mobile Forex trading app (Metatrader) with live quotes for USD/INR and others (Image by D’Vaughn Bell). Mobile platforms like this allow Indian traders to check positions anytime.

That said, desktop is still valuable. On a PC you can view multiple charts simultaneously and run heavy analysis. Many serious traders set up at least one desktop monitor for charting and use mobile as a backup or for quick trades. For newcomers, a mobile app is fine for learning. Just ensure you have internet connectivity and never trade “blind” – always double-check trades on a stable platform.

Learn the Basic Forex Trading Strategies (Beginner Friendly)

Every trader needs a strategy. Here are three beginner-friendly approaches:

- Trend trading: This involves identifying a clear trend (up or down) on a chart and trading in its direction. For instance, if the INR has been weakening steadily versus the USD (uptrend in USD/INR chart), a trend trader might look for small pullbacks to buy. You can use moving averages or trendlines to define trends. In a strong trend, you “ride” it until it shows signs of reversal.

- Breakout trading: Here you look for price breaking out of a range or chart pattern. For example, if EUR/INR has been moving sideways between 80.00 and 81.00 for days, a breakout trader might place a buy-stop order just above 81.00, expecting momentum to carry it higher. Indicators like Bollinger Bands or Donchian Channels can help signal breakouts. Keep in mind breakouts often come with higher volatility, so manage risk tightly (see below).

- Scalping (short-term trades): Scalpers enter and exit within minutes, taking tiny profits repeatedly. For example, a scalper might trade USD/INR when it ticks up or down by 5–10 pips. This method requires discipline and often uses a one-minute chart. It can work with small capital since many small gains accumulate. Use fixed stop-loss and take-profit (e.g. 5 pips) on each trade. Remember: scalping can rack up transaction costs, so low spreads (like Orderglo’s 0.3 pip) help.

No matter the strategy, the key is consistency and simplicity. A common beginner approach is to use just 1–2 indicators (like RSI + 20-period MA) to time entries, rather than dozens of signals. Back-test any strategy on historical charts or demo accounts before using real money.

How to Read Forex Charts Like a Pro (For New Indian Traders)

Chart analysis is fundamental. Here’s a quick guide:

Types of charts: line, bar, candlestick

- Line chart: Plots only the closing prices over time, connecting them with a line. Simple but misses intraday data.

- Bar chart: Each bar shows open, high, low, and close for the period (tick, minute, day, etc.). The vertical line spans high–low, with small ticks for open/close on the sides.

- Candlestick chart: Similar to bar but visually clearer: a “candle” body shows open-to-close range, colored green (up) or red (down) usually. Thin wicks show the highs/lows. Candlesticks are very popular because patterns (like doji, engulfing candles) are easy to spot.

Most beginners use candlesticks. For example, the chart below (for BTC/USD) uses candlesticks and common indicators:

An example price chart with candlesticks, a moving average line, and RSI indicator. Traders draw support (green) and resistance (yellow) zones on the chart to identify key levels.

Simple technical indicators beginners should learn (RSI, MACD, MA)

- Moving Average (MA): Plots the average price over a set number of periods (e.g. 50-day MA). If price is above the MA, trend is up; below indicates down. Crossovers of a fast MA and slow MA can signal changes.

- Relative Strength Index (RSI): Oscillator from 0–100. Readings above 70 suggest “overbought” (possibly due for a pullback), below 30 “oversold.” Use it to gauge momentum.

- MACD (Moving Average Convergence Divergence): Shows momentum via two EMAs (e.g. 12 & 26 period) and a histogram. A bullish signal is when the MACD line crosses above its signal line.

These are built into MT4/MT5 and other platforms. Focus on understanding what each shows before adding many indicators (too many can give conflicting signals).

Identifying support, resistance, and market trends

- Support: A price level where a down move repeatedly stops and bounces. Indicates buying interest. On charts, it’s often drawn as a horizontal line where past lows occurred (see the green zone in the image above).

- Resistance: A level where an up move stalls (sellers enter). Drawn at past highs (yellow zone above).

- Trend lines: Diagonal lines drawn along rising lows (uptrend) or falling highs (downtrend) indicate direction. A break of a well-drawn trendline can signal trend change.

- Chart patterns: Beginners should watch for simple patterns like triangles, flags, or double tops/bottoms, which can foreshadow breakouts or reversals.

Learning to “read” charts takes practice. Start by examining a pair like USD/INR on a daily chart: draw a few lines and ask, “Is price generally moving up or down? Where has it bounced before? What do the indicators show?” Over time, chart analysis will become second nature.

Managing Risk While Trading Forex in India

No matter the strategy, risk management is paramount. Even the best traders protect their capital first.

How to calculate position size and risk per trade

- Risk percentage: A common rule is to risk no more than 1–2% of your account on a single trade. If your account is ₹100,000, risking 1% means you risk ₹1,000 per trade.

- Position sizing: Once you pick a stop-loss (e.g. 30 pips on USD/INR), calculate lot size so that a 30-pip move equals your ₹1,000 risk. For USD/INR, 1 pip ≈ ₹1 for a 0.01 lot, ₹10 for 0.1 lot, ₹100 for 1 lot. So 30 pips × ₹100 = ₹3,000 (risk for 1 lot) – too high if you wanted ₹1,000 risk. In that case, use 0.33 lots, etc. Many brokers or websites have pip/margin calculators to do this math.

- Margin and leverage: Remember higher leverage means smaller margin for the same trade size, but it doesn’t change the absolute risk in your currency. Always check the margin requirement so you don’t get a “margin call” unexpectedly.

Importance of stop-loss and take-profit

Always use stop-loss orders to cap your loss at a predetermined level. Likewise, set a take-profit to lock in gains. As Bajaj Broking emphasizes, risk control means “setting exposure limits, using stop-loss levels, and not using too much leverage”. In other words, plan each trade: decide where you will exit if the trade goes well (take-profit) or badly (stop-loss) before you enter. Never trade without them, as emotion can lead you to close too late.

A disciplined approach: risk $100 to make $200 (2:1 reward-to-risk) rather than chasing huge winnings with no stop. Markets are unpredictable; stops ensure one bad trade doesn’t wipe out gains.

Avoiding common beginner mistakes that cause losses

- No trading plan: Entering trades on a whim or “feeling” is dangerous. Always have a plan (setup, entry, exit, risk).

- Chasing tips or signals: Blindly following social media tips or unverified signals is a recipe for losses. What works for one trader may not suit you.

- Overtrading: Trading too often, especially on low-confidence setups. This often comes from boredom or FOMO. Stick to your strategy and wait for quality setups.

- Emotional trading: Greed and fear cause many mistakes (holding losers too long, or exiting winners too soon). Trading should be logical, not emotional. Some traders use trading journals to review and learn from mistakes.

By adhering to strict risk rules and avoiding these pitfalls, beginners significantly improve their long-term chances.

How Much Money Do You Need to Start Forex Trading in India?

Minimum capital required for different account types

There’s no single answer; it depends on the broker and your strategy. Many retail Forex accounts can be opened with as little as $100 (₹8,000) on micro accounts. However, to make meaningful profits, larger capital is better. As an example, Orderglo’s account tiers start at a $500 minimum deposit for the Standard account. This $500 (about ₹40,000) account offers 0.3 pip spreads and 1:300 leverage. Their Premium account requires $5,000 (₹400,000) with tighter spreads and 1:400 leverage.

The point: begin with what you can afford to lose. Even ₹10,000 can be a starting demo balance. Increase capital as you gain skill. Some brokers let you trade even ₹1,000 (with high leverage) but beware – small accounts can vanish with a few losses.

Understanding leverage and margin requirements

Leverage allows trading large positions with small capital. For example, at 1:300 leverage, $500 can control $150,000 of currency. This magnifies both profits and losses. A 1% move on $150,000 is $1,500 – three times your $500. Understand the margin requirement (the amount locked for a position). If USD/INR is 83, and you trade 1 lot (100,000 USD), at 1:300 leverage you need only about $276 (₹23,000) as margin for that 100,000 USD/INR trade. But if INR moves against you 1%, you lose $1000 (₹83,000), wiping the account. So use leverage wisely.

Always check margin levels (displayed in your platform) to avoid “margin calls” (forced liquidation when funds run out). Beginners should use moderate leverage (e.g. 1:50 or 1:100) until they gain experience.

Low-budget trading tips for Indian beginners

- Use demo accounts: Start on a virtual (demo) account to learn the platform and strategy with no risk. Most brokers offer free demo accounts.

- Micro-lots: Trade in tiny lot sizes if capital is low. Even 0.01 lots (micro) can capture pips while risking minimal money.

- Risk only small %: Stick to 1% rule as discussed, especially on small balances.

- Gradual scaling: Increase your trading size only as you consistently win.

- Leverage prudently: Just because 1:300 is available doesn’t mean you should use all of it. Start with 1:10 or 1:20 and move up.

- Consider a funded challenge: Some brokers (like Orderglo’s OG Challenge) let you trade a funded account by passing a low-risk demo test, which is a way to handle larger capital with a small fee.

Always remember: trading is not a get-rich-quick scheme. Building a sizable account takes time, discipline and compound growth.

Common Forex Trading Mistakes Indian Beginners Must Avoid

Learning from others’ mistakes is key. Here are some common pitfalls:

- Trading without a plan or risk rules: Entering trades impulsively, without defined entry/exit or risk, leads to chaos. Always set your stop-loss and stick to it.

- Following social media tips blindly: Unverified “Hot tips” or signals from YouTube/Twitter often come from sellers trying to make money off newbies. Always do your own analysis.

- Overtrading and revenge trading: Trading too frequently or trying to immediately recover losses typically makes things worse. If you have a losing day, it’s often best to take a break and stick to your strategy on the next good opportunity.

- Ignoring risk management: Using too much leverage or no stops is a big mistake. Consistent traders preserve capital above all.

By avoiding these mistakes, a beginner greatly increases their chance of survival and eventual success in Forex.

Frequently Asked Questions (FAQs) by New Indian Forex Traders

Q: Can I trade forex legally through international brokers?

A: Technically, Indian residents should only trade currency futures/options on NSE/BSE. Trading through most overseas brokers is outside RBI’s authorized routes. In practice, many Indians do open accounts with overseas brokers, but this is not covered by Indian law and can be risky. If you choose this path, understand it is not officially sanctioned by RBI. For fully legal trades, use SEBI-regulated currency contracts.

Q: How much profit can a beginner realistically make?

A: Profit varies widely. Very few newbies make large, consistent profits. In fact, studies show most retail traders lose money. For example, a US CFTC study found the median small account lost about $100–$200. Only a small percentage of traders were profitable. So beginners should be realistic: aim for small, steady gains and education. Don’t expect quick riches.

Q: Is forex trading taxable in India?

A: Yes. Any gains from Forex trading are taxable. Generally, profits are treated as business income (since trading is an active endeavour). You would report it under “Profits & Gains of Business or Profession” and pay tax at your slab rate (up to 30% for high earners). If trading on NSE/BSE, you may also need to pay STT/GST on turnover (currently 0.018% on derivatives in India). It’s wise to consult a tax professional. Note: losses from trading can usually be set off only against trading profits (not other income).

Q: Is forex trading safe for students or working professionals?

A: It can be done part-time, especially now that mobile trading is available. Many Indian students or salaried people experiment with Forex, but “safe” is relative. You should treat it like any side hustle or skill development. Keep your trading capital small relative to your savings. Make sure it doesn’t distract from studies or work. Some platforms report that a large share of new traders are aged 18–30 (often students) with small accounts. If you’re disciplined about learning and risk, it can be a learning experience. But if you need quick money or hate losses, it’s risky.

Final Thoughts: Should Indian Beginners Start Forex Trading?

Forex trading offers exciting opportunities but also significant risks. Let’s weigh the pros and cons:

- Pros: Huge global market with round‑the‑clock trading. No single stock can swing your account by 10%, but currencies can move a few percent a day, offering strong short-term opportunities. Online brokers give easy access (even 0 leverage free demo accounts). Learning Forex teaches you about global economics and markets. For those who master it, it can be a profitable skill and even a part-time income stream.

- Cons: High leverage means small mistakes can lead to large losses. Emotional/undisciplined traders often fail. The majority of beginners lose money, especially if they risk too much. Moreover, Indian regulations complicate things (only INR pairs legally, offshore brokers not protected).

Who should start? Traders who have a genuine interest, patience to learn, and money they can afford to lose. People who can think analytically and remain calm under pressure. Having extra cash (not needed for living expenses) is also wise, since you will likely lose some before learning enough to profit.

Who should avoid? Those looking for a “get rich quick” or easy paycheck. People who have immediate financial needs. Or anyone unwilling to study or manage risk. Forex is not a lottery – treat it like a skill, not gambling.

Next steps to continue learning:

- Educate yourself: Read reliable books and websites. Orderglo’s Academy has free guides and webinars (see our Free Trading Guides link on Orderglo.academy).

- Demo trade: Practice your strategy on a risk-free demo account before using real funds.

- Follow the news: Track global economic calendars to see real events that move currencies.

- Network carefully: Join trader communities (like trading forums), but be skeptical of paid “courses” that promise guaranteed profits.

- Start small: If you switch to live trading, begin with micro-accounts. Keep a trading journal to review your performance.

- Request support: When ready to trade, consider platforms with solid support. Orderglo, for instance, offers account managers and 24/5 help to Indian clients. You can request a quote or demo from Orderglo’s site to explore their platform and tools firsthand.

Ultimately, the decision is personal. Forex trading can be a rewarding endeavor for disciplined Indian beginners, provided they start with a strong foundation of knowledge, use tools like Orderglo’s platforms and educational resources, and always manage risk carefully. If you decide to proceed, do so step-by-step, keep learning, and start with the mindset of a student rather than a gambler. Best of luck on your forex journey!

One Reply to “How to Start Forex Trading in India (2025 Beginners’ Guide)”

Kanagavel RDecember 11, 2025

Many thanks to you sir..